The Advantages of Pawnshop Loans

One major benefit of pawnshop loans is the speed of the transaction. Borrowers can often obtain money within minutes of bringing their objects into the shop, making this feature ideal for urgent financial wants. Additionally, for the reason that mortgage is secured by collateral, credit historical past usually doesn't play a significant role within the approval course of, making it accessible for higher-risk individu

Not only does Be픽 provide instructional materials, however it additionally helps evaluate totally different pawnshops, together with their interest rates and terms. This consolidation of data empowers debtors to make the absolute best decisions when in search of a pawnshop mortgage, supporting financial literacy and accountable borrowing practi

n The rates of interest for housewife loans usually range from 6% to 15%, relying on various factors such as the borrower’s credit rating and the lender’s policies. It’s important to shop round since charges can considerably affect the entire reimbursement amo

What Are Same-Day Loans?

Same-day loans are short-term financing options that allow people to safe funding quickly, sometimes within the same day they apply. They cater to various wants, together with medical emergencies, car repairs, or surprising bills. These loans are sometimes unsecured, which means borrowers do not want to provide collateral, which can enhance accessibility for so much

First, it is important to gather all the mandatory documentation. This usually contains identification, proof of residence, and any documentation related to your employment historical past or present financial status. Having these materials prepared can expedite the application course

Funds from a same-day mortgage are often deposited into the borrower's checking account inside hours after approval. However, the precise timing can depend on the lender's policies, the time of the applying, and the borrower's financial institution processing occasions. It's important to make clear these details with your preferred lender when apply

Also, run the numbers to know whether it is possible for you to to handle repayments when you secure employment again. It's important to method loans with a *strategic mindset*; understanding your future earnings potential is essential to managing long-term debt successfu

Additionally, some lenders may supply assistance in constructing your credit profile. By handling your mortgage responsibly, you probably can doubtlessly enhance your credit score, which can open doorways Loan for Delinquents better monetary choices sooner or la

The Application Process

The utility process Loan for Bankruptcy or Insolvency a enterprise mortgage can differ considerably from lender to lender. Typically, the method begins with submission of an application form. You'll need to supply particulars about your small business, your monetary state of affairs, and the aim of the l

These monetary tools can be of great help, especially during unanticipated circumstances similar to layoffs or sudden job loss. Borrowers should fastidiously think about their options since loans can sometimes include high-interest rates due to the perceived danger by lenders. Therefore, it is crucial to **research** and look for the most favorable phrases out th

When to Avoid Taking a Same-Day Loan for Day Laborers

While same-day loans may be helpful, they aren't an overall answer for every monetary downside. It is advisable to keep away from same-day loans should you can not afford the repayments or in case your financial scenario is unstable. Choosing this selection may lead to a cycle of debt that exacerbates monetary anxiousn

One of the most important things to notice is that each lender has a unique approach to assessing threat. Many will think about firm credit scores, revenue history, and total monetary performance. As a borrower, it’s important to have your financial paperwork organized and ready earlier than initiating the mortgage software proc

Typical reimbursement terms for monthly loans can range from as short as six months to as long as ten years or more, relying on the lender and the quantity borrowed. Shorter phrases can mean greater monthly payments however much less curiosity paid general, whereas longer terms generally lead to lower month-to-month payments but higher total curiosity pri

The platform also equips users with comparison instruments. You can **compare numerous lenders and their offerings**, making it easier to establish which choices are finest suited to your needs. The reviews typically spotlight essential particulars that general overview websites would possibly miss, thus offering perception into the appliance process, service quality, and buyer supp

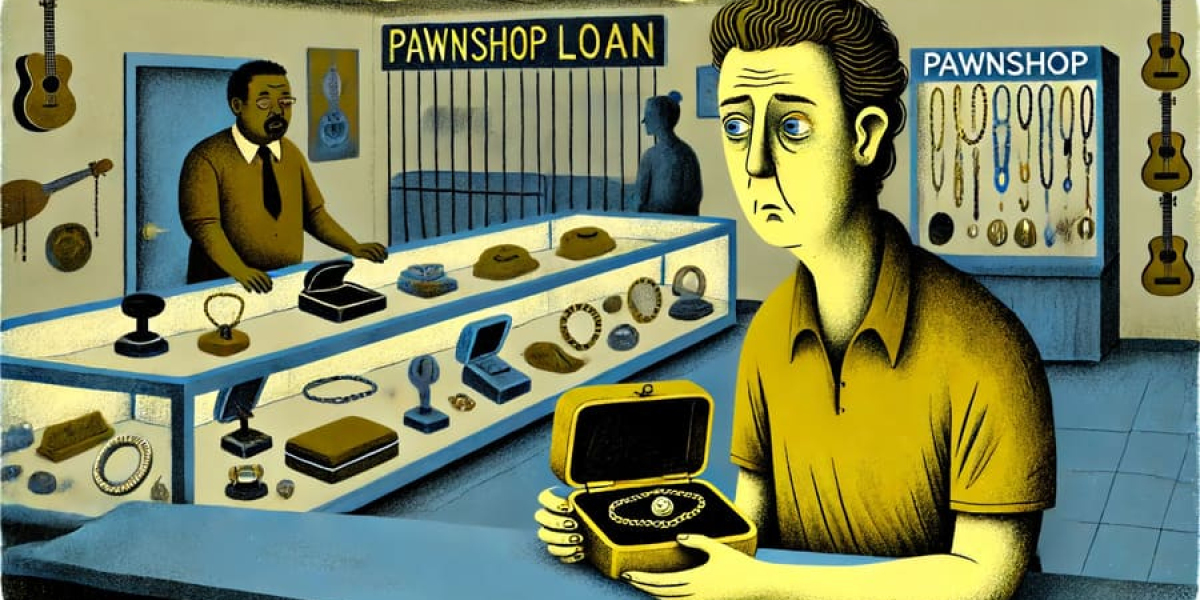

What Are Pawnshop Loans?

Pawnshop loans are short-term loans that permit borrowers to secure funds by providing collateral, normally in the type of valuables or items of value. The course of involves bringing a valuable item, similar to jewelry, electronics, or collectibles, to a pawnshop. The pawnbroker evaluates the merchandise and offers a mortgage amount based mostly on its assessed worth. The borrower can then choose to just accept or decline the sup

charap86291995

29 Blog posts